Travel requires money.

I know this will not come as a shock to anyone, especially in this day and age when even using an air compressor at a gas station can set you back $1.

Yes, travel can sometimes be downright expensive. But the key to affording even your wildest travel dreams is to start saving, and start saving early. Because, unless you are independently wealthy, have just won the lottery, or stand to inherit a big chunk of cash, odds are you can't just set off on an expensive adventure on a whim. It takes some planning. It takes some plotting. And, yes, it takes some budgeting.

Last week, I posed a question on my Facebook page to my fellow travelers, asking how they go about cutting costs and saving up for a big trip. Whether you're headed on a round-the-world adventure, moving abroad, or simply going away for a week or two, the money-saving tips they shared can help you.

Tips for saving money for travel

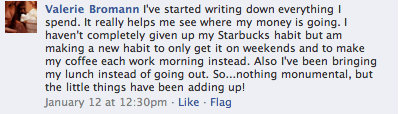

1. Track your expenses.

This is probably the number one tip any budget-conscious person will give you when you begin to think about saving up for a trip. For a week, write down every penny you spend — yes, even that pack of gum or can of Pepsi out of the vending machine counts. Writing everything down can help you see where your paychecks are going, and what you can potentially cut down on. Even the little things can add up over the course of a week or month.

Val, for example, says she's cutting down on her Starbucks consumption. I'm betting this saves her a nice chunk of money each week that she can then deposit into her travel fund.

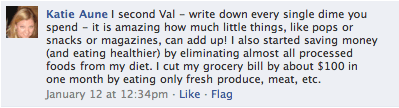

2. Eat fresh foods.

Cutting down on things like Starbucks lattes and pricey lunch dates can go a long way in helping you save up for your trip. But, as Katie points out, eating healthier can help, too — and in more ways than one. Buying fresher foods not only will save you a little money each month, but it also means a healthier, more energized you. And more energy is always a good thing when you're on the road.

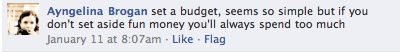

3. Budget “fun money.”

Once you've tracked your expenses for a month and decided where you are able to make cuts, it's important to not cut everything out entirely. If you never go see a movie with your friends or always refuse to go out to dinner with your significant other, you may soon find yourself in a miserable rut. Sure, you have that big trip to look forward to, but what if it's months or even years away?

Set aside a separate “entertainment” budget each month for things like nights out with friends, dates, sporting events, concerts, shopping trips and anything else you might do for fun. Like Ayngelina warns, if you don't set aside this “fun money,” you're more likely to fall off the wagon at the mall or video game store or that fancy restaurant and spend much more than you want to.

And, just because you're saving up for a big trip sometime in the future doesn't mean you can't travel at all until then. Sometimes planning an affordable “mini break” can do wonders for you and temporarily satiate that travel bug.

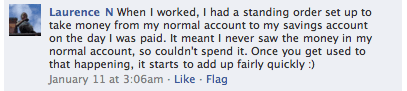

4. Have money directly transferred into your travel fund.

This is probably the easiest way to save money that I can think of. I do it, too. Each paycheck, I transfer $50 from my checking account into my savings account. Because I can't access my savings with a debit card or check, I can't spend it on a whim (you know, like when I fall off the wagon because I failed to budget any “fun money”).

You of course can set this up however works best for you, but, as long as you have income coming in, this is a great way to redistribute your income and add some padding to that travel fund. And, once you factor in having $50 less per week (or whatever your contribution will be), you'll automatically start cutting out unnecessary expenses without even realizing it.

5. Live rent-free.

This obviously is not an option for everyone. I, for example, have a full-time job that's 3 hours away from Mom and Dad. Unless I quit my job and had nowhere else to turn, moving back home would not really be an option.

But, if it is an option for you, it's worth considering. Especially if you're planning an extended round-the-world trip, or preparing to travel indefinitely, moving back in with the ‘rents temporarily can save you a huge amount of money. Even if Mom and Dad want you to pay a little bit of rent, or maybe pitch in for groceries, you're still likely to save a lot each month by not having to pay full rent and utilities. And, moving back home will probably force you to get rid of a lot of the useless crap you've accumulated over the years… which is only ever a good thing.

6. Keep an eye out for free events and deals.

This hearkens back to budgeting “fun money,” except that this tip doesn't have to cost you anything! There are a lot of free events and entertainment options in most cities, if you know where to look. And, like Lauren suggests, simply keeping an eye out for restaurant deals or happy hours can save you some cash, too, when you do decide to spend some of your fun money.

And, even if it seems like something only your grandma does, cutting coupons is also worth the extra time. These days, you can go online and search for coupons for everything from restaurants to home goods to dance classes on popular sites like Groupon. If you find a killer coupon for a restaurant or event, perhaps plan that for your next evening out. Not only will you be getting out of the house, but you'll be saving money doing it.

7. Keep less cash on-hand and leave the cards at home.

There's an old saying that goes “out of sight, out of mind.” For the most part, this is true. Keeping less cash on hand can often mean spending less. Unless, of course, you have a debit card or credit card readily available in your wallet.

If you really want to resist the temptation to spend that money you've been working so hard at saving up, leave the plastic at home when you go out, and take only the amount of cash you think you'll need. That way, you'll be less tempted to spend more than you should.

8. Spend less.

This, of course, is a given. But simply resisting the urge to buy that dress or fancy new gadget you don't need can go a long way in helping you save money. Like Annie says, ignore all those sales. Even if $10 really is a great deal for those jeans and you can get 3 pairs for the price of 1, it doesn't mean you need 3 new pairs of jeans. If you are contemplating a large purchase, sleep on it for a few nights — or even a week — and then decide if you really need it (and whether you can truly afford it).

And, as Annie adds, forgoing the alcohol or expensive meals when out with friends is also a great way to spend less. This doesn't mean you shouldn't go out (remember — “fun money!”), but you should be more conscious of your spending when you do. Perhaps limit yourself to just 1 or 2 drinks. Order appetizers instead of a meal. Or maybe split a dish with a friend (I mean, c'mon, do you actually EVER finish a whole meal at a restaurant?).

9. Cut down — on everything.

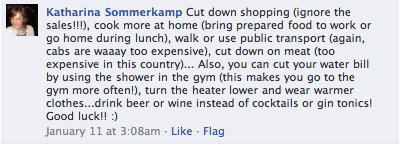

Again, this is a given, but Katharina adds some great tips for anyone looking to save money. Using public transport more when available will cut down on gas (which is so expensive these days), and can also help reduce your carbon footprint — it's a win-win!

Using less water and electricity can help cut down on your utility bills. And maybe you can even weigh whether you really need that expensive cable plan with DVR. Isn't that what the Internet is for now?

I recently reduced my bills slightly by moving in with a roommate. While I'm not seeing exponential savings, it has helped me save a little bit here and there. Plus, now I have someone to talk to about all the travel I'm saving up for!

These tips, of course, don't just apply to travelers. In the current economy, it seems everyone is looking for ways to save a buck here and there. So, whether you're saving for a RTW trip, to buy a car, or maybe even to purchase your first home, these tips are relevant and can be applied to your situation.

What money-saving tips would you add to this list? Have you saved up for a trip using any of these methods, or perhaps another way not listed? Share what worked and what didn't in the comments below!

Pin it for later:

Amanda Williams is the award-winning blogger behind A Dangerous Business Travel Blog. She has traveled to more than 60 countries on 6 continents from her home base in Ohio, specializing in experiential and thoughtful travel through the US, Europe, and rest of the world. Amanda only shares tips based on her personal experiences and places she's actually traveled!

Hi Amanda this is a very handy list of tips for saving. However these are mostly pre-travel saving tips, which is great if you are planning to save for your next trip but here is a quick tip for saving while you are travelling. I believe accommodation and food can prove to be most expensive while travelling so instead of living in a hostel (where you still get to pay, and the discomfort!) you can cut down on these expenses by volunteering, work exchanges with locals in return for food and accommodation. For this I would like to suggest http://volunteerstays.com/ It’s a great site if you want to stretch their travel dollars.

Thanks for the suggestion, Ali. Volunteering can indeed be a great way to cut back on expenses once you’re on the road.

[…] 9 Money-Saving Tips for Travellers posted on A Dangerous Business […]

Thanks for the tips. A tip I would give people is to research where you are going. Some countries and places are twice or trice as cheap as the country next to it. Living expenses have nothing to do with the beauty of a country or the quality of life of a traveller.

A very good piece of advice, for sure! Thanks for sharing!

That’s a pretty nice list of money-saving ideas! I just can’t imagine moving back to my mom & dad, though. Maybe that’s because I have a wife and 2 kids, and my parents are divorced. Hmmm… 😉

Haha, well, yes, that would make moving back in with your parents a bit awkward…

Thanks for reading!

A tip that a lot of people think they’ve covered is to not buy brand named products, but they tend to go about it the wrong way by jumping from Herbal Essences to making their own conditioner with apple cider and baking soda, the trick is that each time you go shopping, drop down one brand level at a time.

So Herbal Essences down to a cheaper brand, then down to supermarket own brand, then down to supermarket value. And when you’ve dropped a level and you can notice a negative difference to the change you stop and go back to the last level. I’ve saved loads over the past few months and if I decide to splash out and say buy a bottle of Mountain Dew or Irn Bru, I then put double what I paid for the luxury into my saving account.

And one quick one is to save your change. I’m not talking about your shrapnel (really small change) but anything under a dollar (or in my case £1). I’ve got a load of bags full of change with a load of 50p’s in there too so when I cash it in a couple of days before I set off on my next trip, I’ll have some extra pocket money!

Haha, now I’m just picturing washing my hair with apple cider and baking soda… gross. But that’s good advice about the brand name vs. store brand products. Most of the time there’s not going to be much difference in products, but you don’t want to totally sacrifice quality to save 50 cents, either.

And saving your change is smart, too. I do that all the time, even if I’m not saving up to travel!

Thanks for the great read. Keep it up!

I love how you pasted in the Facebook comments like that — I’ve never seen that before. Brilliant idea! And I could definitely use some of these tips…

Thanks! I just did screen captures on the FB comments, and I like how it turned out, too! It saved me scrounging around for more generic photos to use. And who can’t use a good money-saving tip now and then, right?

Great tips!! I really like your site…People tend to think that making a RTW trip is too expensive but the truth is that it can be quite cheap if you control yourself and save. You can try to find a job while traveling. Last year I spent two months working in a spa Mexico institute whereas my boyfriend worked in a Mexico golf resort carrying the golf clubs. Try to make reservations in advance to save money in hotels, or try to find cheap flights on the Net. Last year, i bought cheap packages Mexico offers. There’re many ways to save. Traveling just depends on you!!

Glad to see mine make the list. Since I posted that on your FB page, my parents and I have actually decided I am not going to crash with them until my lease is up in late September. So, I will be looking to these other tips to help close the gap on savings the rest of the year. One thing that didn’t specifically get mentioned but may just fall under “Spend Less”, that I will be looking at is dating. Dating can be very expensive, and I actually have made a decision in the last few weeks to cut back on going out on dates or stop all together here soon. It is fun, sure, but with me planning on leaving the country for an extended period in early 2012, where is it really going to lead?

I was wondering how you were offering to host my sister and I in August if you were planning to move back in with your parents in June. It all makes sense now!

Interesting about the dating thing. It IS really expensive, especially if it’s not serious. You probably can’t suggest to a girl on a first date that you sit in your PJs and watch a House marathon (unless she’s awesome, of course).

LOL, yes it was more of a situation where I had made plans without checking with them about it, ha. Anyway, yes you are right, only the coolest girl in the world would go for that on a first date!

Good tips! I recommend to people who are saving and have the old 9-5 job to pick up something small on the weekends. I got a job bartending just on Saturday nights, and doing that just one day a week brought in no less than $100 a week (usually more, $100 was a bad night!). It was fun, too!

That’s a great tip! Yes, it means giving up a night of your weekend, but it wouldn’t take very long at all to pad your savings account making an extra $100 per week!

This is a really helpful post to travelers. I love all of the different ideas. There are a few here I hadn’t thought of before. When I spent 3 months in Italy, leading up to it, I lived at home and saved. I also can work as I travel so that definitely helps. Most people have to take off vacation time, and they aren’t getting paid. If you want to travel for a long time, you can always work and travel. I think the best way to save is to just not spend. I limit everything, from food to going out. Sure, you can seem like a loser, but for me it is worth it to travel rather than have that beer every Friday and Saturday night.

Thanks, Suzy! I’m glad you found it helpful. The great thing about most of these suggestions is that they’re not very difficult to do!

And I agree – travel is definitely worth some sacrifices.

These are all great tips. I’ve been keeping track of my spending and it’s crazy how quickly money can disappear. Of course I’m in school, so it’s never good for my travel budget when I’ve gotta spend $400 on textbooks.

Thanks, Alouise! It IS crazy how quickly money can disappear. I don’t even spend a lot on dinners or “extras,” but money still seems to fly out of my bank account each month on rent, bills, gas, making payments on my credit cards… I don’t even want to think of the expenses I’ll have when I head back to school in the fall!

God, Australia is so flipping expensive. If Pat and I moved back in with his parents we could save for a RTW trip in a year just on that!

Australia IS expensive. I went to Sydney and Perth for a week when I was studying abroad in NZ, and I was amazed at how pricey everything was. I mean, the prices weren’t all that different from in NZ, but the exchange rate in NZ was much better. Luckily, though, I was visiting my uncle in Perth, so I didn’t have too many expenses.

Australia is a nightmare when it comes to trying to save for a big trip. So expensive and so full of expensive temptations!

Thanks for posting this terrific collection of tips. (Given the nature of our site, we’re of course partial to the tip about keeping track of your spending!) I think the number one way to put money into your savings account each month is to make sure that you first put money away, an then live off of the rest. Too many people are living up to their means (or above their means) when we should all be living well below our salaries. It’s really all about prioritizing.

I’m glad you found this useful! I’m by no means an expert on financial planning or budgeting, but a few simple saving tips really can go a long way.

And you’re right about that last part — living below our salaries. If everybody did that, there would be far less people up to their ears in debt!

Good tips overall although I completely disagree with #7.

If you’re a responsible spender and buy only what you can afford, credit cards are a great for several reasons.

1. You get cash back. Most cards offer 1% cashback on everything, some even offer 2% (like the now-defunct Charles Schwab Visa). Although it may not seem like much, it adds up. Spend $1000 a month, get $20 back on the 31st.

2. You get miles and fat rewards. The last two trips I’ve taken (Honduras and Guatemala/Belize) have been on free flights (not including taxes and a late fee) because of credit card mileage promotions. Sometimes they have ridiculous offers like the AA 75k offer going on right now. I applied and got both a Visa and Amex which netted me 150k miles, enough to get multiple roundtrip flights. Most of the other airlines will have cards which give you 25-30k the first time you sign up. Cash back offers are also out there, although I haven’t seen any lately. Check out http://www.fatwallet.com/finance and http://www.flyertalk.com for the most updated info.

3. It’s 30 days of free interest. You don’t have to pay your bill until 30 days later so its essentially borrowing 30 days of money for free. May not be much but could add up if you put a lot on your cards every month.

I pretty much put every dime on my cards, except for places that don’t take cash. Plus, who wants to deal with change anyways 😉

Good points when it comes to using credit cards! For some people though (me included), credit cards can be dangerous. I, for example, have a couple thousand dollars in credit card debt that I’m still trying to pay off from studying abroad and then moving to accept a new job. It’s not a TON of debt, but it still isn’t ideal. It’s one thing if you’re able to pay off your balance every month. But, if you can’t, those interest rates can be killer!