Travel requires money.

I know this will not come as a shock to anyone, especially in this day and age when even using an air compressor at a gas station can set you back $1.

Yes, travel can sometimes be downright expensive. But the key to affording even your wildest travel dreams is to start saving, and start saving early. Because, unless you are independently wealthy, have just won the lottery, or stand to inherit a big chunk of cash, odds are you can't just set off on an expensive adventure on a whim. It takes some planning. It takes some plotting. And, yes, it takes some budgeting.

Last week, I posed a question on my Facebook page to my fellow travelers, asking how they go about cutting costs and saving up for a big trip. Whether you're headed on a round-the-world adventure, moving abroad, or simply going away for a week or two, the money-saving tips they shared can help you.

Tips for saving money for travel

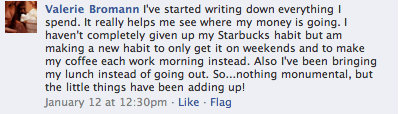

1. Track your expenses.

This is probably the number one tip any budget-conscious person will give you when you begin to think about saving up for a trip. For a week, write down every penny you spend — yes, even that pack of gum or can of Pepsi out of the vending machine counts. Writing everything down can help you see where your paychecks are going, and what you can potentially cut down on. Even the little things can add up over the course of a week or month.

Val, for example, says she's cutting down on her Starbucks consumption. I'm betting this saves her a nice chunk of money each week that she can then deposit into her travel fund.

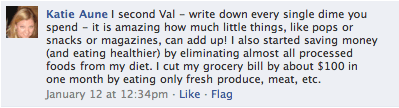

2. Eat fresh foods.

Cutting down on things like Starbucks lattes and pricey lunch dates can go a long way in helping you save up for your trip. But, as Katie points out, eating healthier can help, too — and in more ways than one. Buying fresher foods not only will save you a little money each month, but it also means a healthier, more energized you. And more energy is always a good thing when you're on the road.

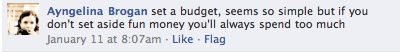

3. Budget “fun money.”

Once you've tracked your expenses for a month and decided where you are able to make cuts, it's important to not cut everything out entirely. If you never go see a movie with your friends or always refuse to go out to dinner with your significant other, you may soon find yourself in a miserable rut. Sure, you have that big trip to look forward to, but what if it's months or even years away?

Set aside a separate “entertainment” budget each month for things like nights out with friends, dates, sporting events, concerts, shopping trips and anything else you might do for fun. Like Ayngelina warns, if you don't set aside this “fun money,” you're more likely to fall off the wagon at the mall or video game store or that fancy restaurant and spend much more than you want to.

And, just because you're saving up for a big trip sometime in the future doesn't mean you can't travel at all until then. Sometimes planning an affordable “mini break” can do wonders for you and temporarily satiate that travel bug.

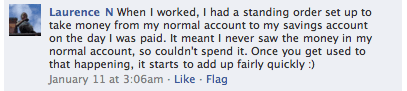

4. Have money directly transferred into your travel fund.

This is probably the easiest way to save money that I can think of. I do it, too. Each paycheck, I transfer $50 from my checking account into my savings account. Because I can't access my savings with a debit card or check, I can't spend it on a whim (you know, like when I fall off the wagon because I failed to budget any “fun money”).

You of course can set this up however works best for you, but, as long as you have income coming in, this is a great way to redistribute your income and add some padding to that travel fund. And, once you factor in having $50 less per week (or whatever your contribution will be), you'll automatically start cutting out unnecessary expenses without even realizing it.

5. Live rent-free.

This obviously is not an option for everyone. I, for example, have a full-time job that's 3 hours away from Mom and Dad. Unless I quit my job and had nowhere else to turn, moving back home would not really be an option.

But, if it is an option for you, it's worth considering. Especially if you're planning an extended round-the-world trip, or preparing to travel indefinitely, moving back in with the ‘rents temporarily can save you a huge amount of money. Even if Mom and Dad want you to pay a little bit of rent, or maybe pitch in for groceries, you're still likely to save a lot each month by not having to pay full rent and utilities. And, moving back home will probably force you to get rid of a lot of the useless crap you've accumulated over the years… which is only ever a good thing.

6. Keep an eye out for free events and deals.

This hearkens back to budgeting “fun money,” except that this tip doesn't have to cost you anything! There are a lot of free events and entertainment options in most cities, if you know where to look. And, like Lauren suggests, simply keeping an eye out for restaurant deals or happy hours can save you some cash, too, when you do decide to spend some of your fun money.

And, even if it seems like something only your grandma does, cutting coupons is also worth the extra time. These days, you can go online and search for coupons for everything from restaurants to home goods to dance classes on popular sites like Groupon. If you find a killer coupon for a restaurant or event, perhaps plan that for your next evening out. Not only will you be getting out of the house, but you'll be saving money doing it.

7. Keep less cash on-hand and leave the cards at home.

There's an old saying that goes “out of sight, out of mind.” For the most part, this is true. Keeping less cash on hand can often mean spending less. Unless, of course, you have a debit card or credit card readily available in your wallet.

If you really want to resist the temptation to spend that money you've been working so hard at saving up, leave the plastic at home when you go out, and take only the amount of cash you think you'll need. That way, you'll be less tempted to spend more than you should.

8. Spend less.

This, of course, is a given. But simply resisting the urge to buy that dress or fancy new gadget you don't need can go a long way in helping you save money. Like Annie says, ignore all those sales. Even if $10 really is a great deal for those jeans and you can get 3 pairs for the price of 1, it doesn't mean you need 3 new pairs of jeans. If you are contemplating a large purchase, sleep on it for a few nights — or even a week — and then decide if you really need it (and whether you can truly afford it).

And, as Annie adds, forgoing the alcohol or expensive meals when out with friends is also a great way to spend less. This doesn't mean you shouldn't go out (remember — “fun money!”), but you should be more conscious of your spending when you do. Perhaps limit yourself to just 1 or 2 drinks. Order appetizers instead of a meal. Or maybe split a dish with a friend (I mean, c'mon, do you actually EVER finish a whole meal at a restaurant?).

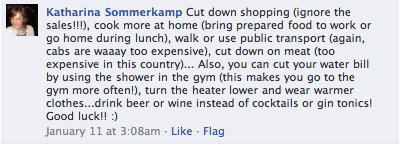

9. Cut down — on everything.

Again, this is a given, but Katharina adds some great tips for anyone looking to save money. Using public transport more when available will cut down on gas (which is so expensive these days), and can also help reduce your carbon footprint — it's a win-win!

Using less water and electricity can help cut down on your utility bills. And maybe you can even weigh whether you really need that expensive cable plan with DVR. Isn't that what the Internet is for now?

I recently reduced my bills slightly by moving in with a roommate. While I'm not seeing exponential savings, it has helped me save a little bit here and there. Plus, now I have someone to talk to about all the travel I'm saving up for!

These tips, of course, don't just apply to travelers. In the current economy, it seems everyone is looking for ways to save a buck here and there. So, whether you're saving for a RTW trip, to buy a car, or maybe even to purchase your first home, these tips are relevant and can be applied to your situation.

What money-saving tips would you add to this list? Have you saved up for a trip using any of these methods, or perhaps another way not listed? Share what worked and what didn't in the comments below!

Pin it for later:

Amanda Williams is the award-winning blogger behind A Dangerous Business Travel Blog. She has traveled to more than 60 countries on 6 continents from her home base in Ohio, specializing in experiential and thoughtful travel through the US, Europe, and rest of the world. Amanda only shares tips based on her personal experiences and places she's actually traveled!

Recycle all empty beer cases. Man, I make a killing.

Hahaha. Now there’s a get-rich-quick scheme if I ever heard one!

I think that those are all good tips, and probably the easiest is the “spend less” and “take less cash” – you can’t spend what you don’t have and taking cash will make you spend less too.

Yes, having less money on you to spend is perhaps the easiest money-saving tip I can think of. It doesn’t actually require you to sacrifice or cut back on anything. It just forces you to only spend what you have!

My favorite is #5, hands down! The best way to save money is to LIVE RENT FREE! (if possible). If you can live rent free, you will surely achieve your savings goals and more. Suck it up and head on home. You won’t regret it! I’ve got a list of great ways that Liz and I saved money for our around the world trip over here… http://su.pr/2x9PxA

Thanks so much for the comment, and for sharing that link! You have some fantastic tips there, too, and I may even have to adopt one or two of them!

Thanks for featuring my comment! But sometimes I don’t follow my own advice, lol.

Haha, isn’t that how it usually goes, Caroline? We can give advice like champs, but then we often don’t take that advice ourselves!

I found that, once we got into the habit of spending less, it wasn’t hard to continue. We still track every dime we spend, have savings goals and follow a budget. Ayngelina’s tip was right on though….budget ‘fun’ money. Just b/c you’re saving doesn’t mean you can’t have fun. If we don’t budget enough to have fun we will inevitably ‘blow it’ at some point and feel bad about it. All are excellent tips! Cheers!

I’m hoping I can continue my money-saving ways even after I save up for the travel I plan to do this year. Getting into a routine of spending less is probably the best habit anyone could hope to pick up!

I’m really glad that you mentioned “fun money.” I’ve been feeling guilty about my nights out and drinks dates with friends lately–but then I realize that I’m not going to see my best friends for the next year! Yes, travel is important (and it’s why I’m selling pretty much everything I own and saving a heck of a lot of pennies)–but so is having a life! I don’t want to sit at home every day, dreaming about the fun things I’ll do when I’m traveling. It’s important to apply that same “experience it in the best way you can” logic to home too–that’s why I’m trying new restaurants, setting up museum dates and wandering around the city whenever I can!

It’s not fair to punish yourself while you’re trying to save money by not allowing yourself to have any fun. You’ll just start to resent the whole savings process! It IS important to still have a life, even if you’re trying to spend less. Being a tourist in your home town or state is a great way to go about this, and I’m glad you’re trying out some new things before you leave!

Great post! This is a topic that can never be covered enough. I’m all about #5 right now. Moved back to my hometown of Chicago to work and couch surf for a solid 9 months in preparation for a RTW trip beginning in May. It’s amazing how much money you can save when you don’t have a house (and a job)…just make sure you’ve got a few friends willing to put up with your shenanigans!

If you’re able to move in with friends or family rent-free, it can do wonders for your savings account – and quick, too! Good luck with your saving! And thanks for reading!

All great tips mate, its funny how just having money come out of your bank on pay day makes you forget it was there in the first place.

I know, right? I’m kicking myself for not setting that $50 aside every week for the first year I was working at my job! Makes me want to cry to think how much I could have saved up by now.

#8 is so true — spend less and AVOID the sales! I swear, unsubscribing from retail emails saved me a fortune. No more amazing sales flashing in my inbox every morning screaming, “BUY ME! BUY ME!” I don’t need any more clothes! 🙂

I’m often a sucker for sales, too! I bought a new camera last month because it was on sale. Did I REALLY need it? No. … But I wanted it, and it was on SALE! Haha. Oh well. A minor saving setback now and again isn’t the end of the world.

[…] This post was mentioned on Twitter by Val Bromann, Amanda Williams. Amanda Williams said: How do YOU save money to prepare for travel? Here are some tips from some fellow travelers. http://su.pr/7FnOD5 #travel #lp […]

Great tips! I’m gearing up for my first solo European trip, any tip I can get is a good one! Thanks!

Glad to have helped! Good luck on your solo trip.

Lots of good tips that apply to everyone, especially tracking your expenses. When you see what you’re blowing money on, it seems easier to save. It’s what I did and it helped me get started on my RTW trip.

Hey Mike! Thanks for reading; I’m glad you liked the tips. Travelers seem to have a really good grasp on what it takes to save up money!

So funny I followed all of these except moving back home as my family lives in another province. The most interesting thing I take away from all of these suggestions is that there is a way to save money if you really want to travel.

Very true, Ayngelina – if you truly want to make it happen, there’s a way to do it that’s right for you. And obviously you found a way to make it work!

Those are great tips! The office coffee machine broke down last month and it’s amazing how much extra change we’ve saved since then. Yes, we whined about it for a week, then somehow managed without that afternoon coffee break just fine. Now I don’t want it fixed (and considering we’re working for the gov, it probably won’t be)

Isn’t it crazy to realize how much you can save just by missing that coffee break every day?

I’m in the middle of saving now (booooring) and I wrote a post late last year and came up with pretty much the same thing….it seems there IS no magic potion-damn! 🙂

Ditching the car was HARD but financially it was the best decision I have made, by a country mile. Everything is directly related to discipline and reminding ourselves why we are doing it. I know this may sound a little cheesy but-I have a “dream board” to keep me right.

It would be so much easier if there WAS a magic potion, though!

You’re right, though – it does take discipline. And I don’t think your “dream board” is cheesy at all! It’s a great motivational tool to remind you what you’re working toward. I hope the saving is going well!

Hell yes it would! That’s cool, my mates just don’t get it. Well I don’t get THEM 😛

I was naughty in December and lost a lot of discipline, but I’m super-tight so far this month in an attempt to recover.

I publish my savings every month on my site. It’s only new and needs a lot done but you’re more than welcome over any time. 🙂

I’ll definitely check your site out. I like the idea of publishing your savings each month. It makes you more accountable in a way by putting it out there like that.

I save change. Everytime I break a bill for whatever and get change back that goes into a travel jar. Without even trying I have over $200 in change saved in two months. When I find a coin it goes into the jar. All the other budget advice is excellent and should be followed. I also assign cash envelopes for different expenses. When the cash is gone from an envelope then I can’t spend more. IF some is left over say for groceries it goes into the travel jar. This way expenses are met and savings happen without pain and suffering.

That’s a great tip, Darlene – I especially like cash envelopes!